I 案例分析题

Suggested answer:

Judicial interpretation of documentary compliance , whether it be strict compliance or one of its equitable rivals, is not adequate to insure the reliability of the letter of credit instrument. Because nearly all documents are in some way discrepant, a standard must be adopted which can consistently discern the difference between a meaningless error and a true discrepancies.

A possible solution to the judicial misapplication of documentary compliance, particularly strict compliance, would be for courts to look to standard banking practice as employed by reasonable document checkers. This standard , advanced by Dr. Boris Kozolchyck, is meant to increase both predictability and fairness in letter of credit transactions.

Fairness in a commercial transaction is normally a function of the reasonable expectations of the parties. Most judicial interpretations of strict compliance fail the fairness test because courts do not define “strict” by examining the expectations of the parties defined by reasonable banking practice. In a practice sense, this standard means that strict compliance can only be determined by the reasonable expectations of an individual who regularly checks documents for an issuing bank. The applicable test for compliance should be whether an experienced and knowledgeable document checker would find that documents are in compliance, despite the fact that they are not mirror images of each other.

Additionally, the International Financial Services Association has promulgated the Standard Banking Practice for the Examination of Letter of Credit Documents. These rules are consistent with the UCP and ISP98 and are meant to provide a more in depth elaboration of standard banking documents, and also detail the various compliance requirements of the most common documents. The application of the principles in the Standard Banking Practice for the Examination of Documents .in conjunction with the UCP or ISP98, and each bank’s internal operating policies and procedures, should allow a reasonable document checker the ability to determine the compliance of documents in nearly every circumstance.

The strongest argument advanced against allowing the judiciary to determine compliance by looking to standard banking practice is the characterization of document checkers as “dumb high school graduates” who are incapable of anything but a purely mechanical and mindless examination of documents. However, this characterization has no basis in reality. While some document checkers have only completed high school, banks do not entrust them to make significant decisions until they have been fully trained. Thus, by the time the document checkers are granted significant decision making authority, they are qualified professionals with a specialized training in letter of credit transactions.

While no standard of compliance can solve all of the difficulties associated with letter of credit transactions, a test based on standard banking practice, as determined by a reasonable document checker, offers the greatest potential for uniformity and harmonization of documentary compliance.

$$分页$$

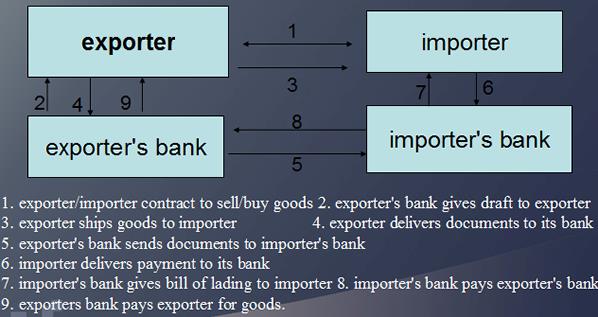

II 图表题

Suggested answer:

$$分页$$

III.论述题

The essence of a Letter of Credit is that the issuer must honor requests for payment that comply with the terms of the Letter of Credit irrespective of any disputes between the applicant and beneficiary regarding the underlying contract between them, or the ability of the applicant to pay the underlying obligation. The issuer of the Letter of Credit (usually a bank) deals in documents and not the facts of the underlying transaction that gave rise to the Letter of Credit. The most important legal rule governing Letters of Credit is the independence of all three of the agreements. This “Independence Principle” gives the Letter of Credit its commercial utility.

The Independence Principle is what distinguishes a Letter of Credit from a Guaranty. Because the obligation of the issuer to pay the beneficiary is also independent of any obligation of the applicant to reimburse the issuer, the issuer must pay on the Letter of Credit even if the applicant has filed bankruptcy and the prospects for reimbursement are grim. Under usual circumstances, the only defense to payment under the Letter of Credit is material fraud in the documents or the underlying transaction. Under such circumstances, the issuing bank may require the applicant to get an injunction from a local court prohibiting the bank from honoring a draw on the Letter of Credit. Because of the Independence Principle, courts use their discretion to grant injunctive relief only in very limited cases where fraud is apparent.

The second important principle governing Letters of Credit is that the issuer must honor a presentment that appears on its face to strictly to comply with terms and conditions of the Letter of Credit. Under this “Documentary Compliance Principle,” if the issuer of the Letter of Credit refuses to pay a draft accompanied by documents that are conforming in all respects, it will be guilty of wrongful dishonor, with sanctions. The sanction for wrongful dishonor is loss of the right of reimbursement.

The bottom line – a creditor with suspicions that its customer’s future obligation to pay may be at risk, is wise to consider obtaining a Letter of Credit to ensure payment. Other forms of security for payment, such as a Guaranty or a lien against the customer’s assets, are subject to the defenses of the customer and the guarantor.